South West rivalling South East as most financially sound region in UK according to one set of research

By Susie Watkins 26th Sep 2023

South West is almost 16% better off than the rest of the UK - according to a new business release.

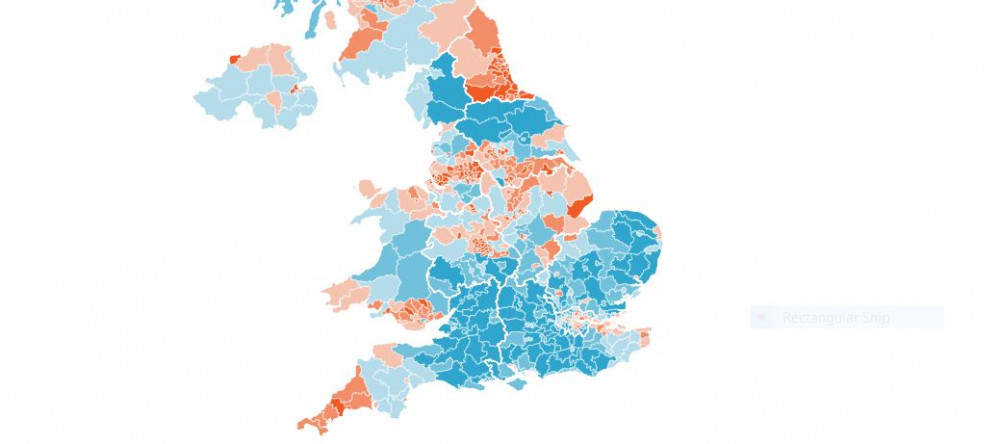

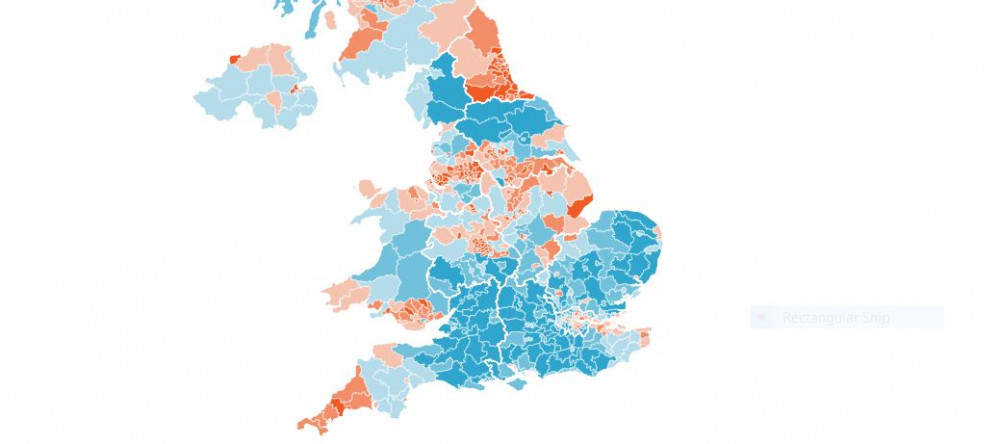

The South West is one of the most financially healthy regions in the UK and is quickly catching up to the South East, according to Lowell's latest Financial Vulnerability Index. With levels of borrowing and adults in default continuing to fall, the region is quickly catching up to the South East and has a change to overtake it as the most financially sound region in the UK.

However, seaside towns, especially Cornwall and certain parts of Devon, are still struggling to recover from the pandemic. All constituencies in Cornwall are more financially vulnerable than the national average. Torbay, Plymouth, Moor View, and Plymouth, Sutton and Devonport also lag behind the UK average.

Commenting on the data, Lowell's UK CEO, John Pears, said: "There's been positive improvements in the South West despite the tough economic conditions of the last year. But we mustn't look over Cornwall or Devon. Clearly there are underlying issues here, brought on by the pandemic, that are acting as barriers to recovery. This is why it's so important that the Government and people in and around the credit industry take the time to understand individual areas to deliver targeted rather than broad-brush support."

National trends

Ordinary working families are bearing the burden of the cost-of-living squeeze. New data from Lowell's Financial Vulnerability Index shows areas with a high proportion of working families have seen a worsening in financial health compared with the UK as a whole in the first half of 2023.

Lowell has identified 133 constituencies which are more financially vulnerable than the UK average. These constituencies are likely to have high numbers of:

- Full-time workers

- Families with children

- Workers in retail

- Workers in manufacturing

- People with no qualifications

Analysis shows areas with high home ownership have also seen limited improvements in financial health, while areas with high levels of social renting are seeing a strong recovery.

Full data set, trends report and interactive tool

The Financial Vulnerability Index is an innovative tool to measure and track financial resilience, nationally and locally, across the UK. Created by Lowell and the Urban Institute, and provided by Opinium, the index brings together publicly available measures and Lowell's proprietary data to give a clear picture of financial vulnerability in the UK.

The full tool can be accessed here. The data can be downloaded for free here and a summary of the key findings are available here.

CHECK OUT OUR Jobs Section HERE!

midsomernorton vacancies updated hourly!

Click here to see more: midsomernorton jobs

Share: